“IV. Working towards a long-term solution – the Asian Principles of Restructuring

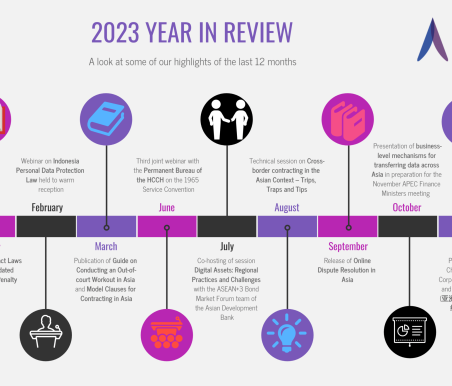

26 Judicial convergence towards a common philosophy of communication and cooperation is but part of the picture. Potential issues remain as highlighted by the very recent judgment of the High Court of Hong Kong in In the Matter of CWU Advanced Technologies (“CWU”) where the question of whether recognition would be given in Hong Kong of a Singapore moratorium granted in a scheme application was raised but ultimately not decided. This brings me to my third point. The long-term solution is the development of a common framework for cross-jurisdictional insolvency and debt restructuring. And here, I cannot neglect to mention the good work of the Asian Business Law Institute (“ABLI”), which is a permanent research institution that was launched in 2016.

27 The ABLI, at its heart, seeks to stimulate the drive towards legal convergence in Asia. The idea for such an institute was first introduced by Chief Justice Sundaresh Menon at the opening of the legal year 2015, in which Chief Justice Menon stated that “[s]uch an institute will bring together Judges, academics, legal practitioners, in-house lawyers and legal thinktanks from the region and beyond to collaborate on the incubation of Asian business law.” ABLI was conceived because the economic impetus for convergence is even more compelling if we consider the patchwork quilt of laws that is characteristic of the Asian legal landscape. Indeed, Asia does not have a common colonial heritage; its countries had varying experiences in the era of emerging nationhood; and certainly, Asia is nowhere near the sort of integration one sees with the EU or NAFTA.

28 The significant heterogeneity of laws that we experience in Asia presents a less than inviting picture for the modern commercial enterprise. A region with fragmented business laws presents a tricky cost-benefit calculus and can add to the cost of expansion in the region. Higher transaction costs can arise in a number of ways – first, there is the cost of familiarisation, which rises with greater divergence in laws; secondly, there is the cost of adapting business and transactional structures when doing business across different jurisdictions; and thirdly, there is the higher cost of resolving cross-border disputes as and when they arise. In the specific context of cross-border insolvency proceedings, for example, a lack of common ground on which courts operate can lead to much uncertainty for debtors and creditors.

29 It is therefore important for Asia to develop a common set of principles which forms a basis upon which courts, regulators, policy makers and insolvency professionals of diverse persuasions can agree to act in a cross-border insolvency. This is where the work and expertise of ABLI becomes so important. One of the earliest projects that ABLI embarked on was a study to determine the best means of harmonising the recognition and enforcement of foreign judgment rules in ASEAN and its major trade partners like Australia, China, India, Japan, and South Korea. As part of that project, a compendium of country reports was published in December 2017, upon which further work is currently in progress to extract common principles for the recognition of judgments. In the field of cross-border insolvency and restructuring, a similar project is already underway. Titled the “Asian Principles of Restructuring Project”, or “the Restructuring Project” for short, this is a project that is jointly undertaken by ABLI and the International Insolvency Institute (“III”). The genesis of the project was to address the concerns I had mentioned earlier by conceptualising a common framework for both in-court and out-of-court restructuring in Asia.

30 The Restructuring Project is a collaborative effort involving some of the leading judges, academics, and practitioners from Asia, Europe, and North America. It consists of two phases. The first phase has already begun, and entails a mapping exercise of the business reorganisation regimes (both in-court and out-of-court) in ASEAN, Australia, China, Hong Kong, India, Japan, and South Korea. The target outcome of the first phase is to publish a compendium of the reports. In the second phase, the results from the mapping exercise will be used to distill and formulate common principles for in-court and out-of-court restructuring which will be published as the Asian Principles of Restructuring.

31 The significance and potential impact of this project on cross-border insolvency and restructuring practice cannot be underestimated. When Chief Justice Menon spoke at the launch of ABLI in 2016, he underscored the practice-oriented identity of ABLI.26 In this vein, the research projects that ABLI undertakes are not purely of academic value; they are intended to effect change and achieve common understanding in the field of practice. Indeed, similar projects undertaken by UNCITRAL, the American Law Institute, and the International Chamber of Commerce, just to name a few, have culminated in success stories like the CISG, the Uniform Commercial Code, and the Incoterms rules respectively. In time to come, it is hoped that, given the stakeholders involved, the product of the project – the Asian Principles of Restructuring – will serve as an integral and authoritative reference tool for judges, legislators, policy-makers and insolvency professionals in Asia.”

The above paragraphs are from the Keynote Address delivered by Justice Kannan Ramesh of the Supreme Court of Singapore at the Singapore Insolvency Conference 2018 on 23 July 2018. Click here for the full transcript.